|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Online Home Refinance Company: Key Insights and ExpectationsRefinancing your home can be a smart financial move, especially when done with the best online home refinance company. In this article, we explore the top options, what you can expect, and tips for navigating the process. Understanding Home RefinancingRefinancing involves replacing your existing mortgage with a new one, ideally with better terms. This can help reduce your monthly payments, lower your interest rate, or tap into home equity. Benefits of Refinancing

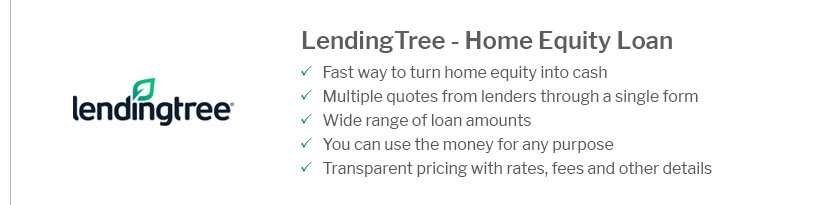

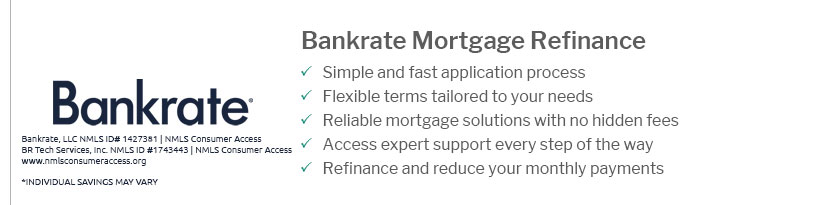

Choosing the Best Online Refinance CompanyWhen selecting a refinance company, consider factors such as interest rates, fees, and customer service. Using an online platform can simplify the process with easy comparisons and applications. Factors to Consider

How to Refinance OnlineRefinancing online is straightforward but requires careful attention to detail. Start by gathering necessary documents, comparing offers, and applying through a secure platform. Steps to Refinance

Additionally, consider options like no pmi refinance to potentially save more. FAQs About Home RefinancingWhat is the best time to refinance my home?The best time to refinance is when interest rates are lower than your current rate, or your credit score has significantly improved. How long does the refinancing process take?Typically, the refinancing process can take 30 to 45 days, depending on the lender and your financial situation. Will refinancing affect my credit score?Refinancing may temporarily lower your credit score due to hard inquiries, but can improve it in the long run with consistent payments. https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

Best Mortgage Refinance Lenders of January 2025 - Best Mortgage Lenders for Refinancing - Lenders in More Detail - Rocket Mortgage - PenFed Credit Union - New ... https://www.bankrate.com/mortgages/best-lenders/online-mortgage-lenders/

Zillow Home Loans boasts an easy-to-navigate, information- and tool-packed website. It also offers special programs, such as one that lets ... https://themortgagereports.com/69718/best-refinance-rates-top-lender-rankings

Use online comparison tools to see the lowest mortgage refinance rates, but remember to look beyond just the interest rate. Consider factors ...

|

|---|